|

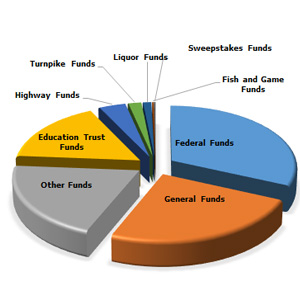

Where The Money Comes From

Where does New Hampshire get the money to fund the services we all use - from individual state agencies, public schools, state universities, law enforcement, highway projects and more? |

|---|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

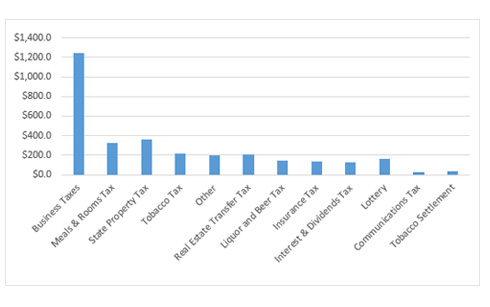

Unrestricted Revenue - General Fund and Education Trust Fund

Certain sources of funds are to be used for specific purposes. Federal program revenues are used only for the purposes of those programs. Also, revenues from Highway, Fish & Game fees, Turnpike Tolls and other "restricted purpose funds" are used only for expenditures within those funds. Unrestricted revenues are those sources of funds for use by the General and Education Trust funds. The chart below shows the "types" of revenue that are collected for these purposes.

Dollars are estimated in Thousands and reflect Chapter 106, Laws of 2023 (HB1) revenue estimates and does not include adjustments in Chapter 79, Laws of 2023 (HB2) or within the Committee of Conference Surplus Statement.

| General and Education Fund Grouping | Estimate FY 2024 | Percentage of Total Estimate |

|---|---|---|

| Business Taxes | $1247.0 | 39% |

| Meals and Rooms Tax | $320.6 | 10% |

| State Property Tax | $363.1 | 11% |

| Tobacco Tax | $214.4 | 7% |

| Other | $203.1 | 6% |

| Real Estate Transfer Tax | $210.0 | 7% |

| Liquor and Beer | $149.1 | 5% |

| Insurance Tax | $140.0 | 4% |

| Interest and Dividends Tax | $122.8 | 4% |

| Lottery | $160.0 | 5% |

| Communications Tax | $30.0 | 1% |

| Tobacco Settlement | $40.0 | 1% |

| Total Funding | $3,200.1 | 100% |

| Source: Chapter 106, Laws of 2023, HB1, Section 1.07 Summary | ||

| Does not include footnotes and other adjustments from Chapter 79, Laws of 2023 (HB2) | ||

Unrestricted Revenue Sources Defined

- Business Taxes

Business Taxes are comprised of the Business Profits Tax (BPT) and the Business Enterprise Tax (BET). - Communications Tax - RSA Chapter 82-A

The Communications tax is assessed monthly at a rate of 7% on two-way communication service billings in excess of $12. - Insurance Tax

The Insurance tax is equal to 2% of premiums on policies that insure risks within the State. The tax also applies to certain nonprofit health insurers and dental insurers. - Interest and Dividends Tax - RSA Chapter 77

Interest and Dividends tax is imposed at 5.0% of income received from interest and dividends. In order to be subject to the tax, individuals must have at least $2,400 of interest and dividend income and joint filers must have at least $4,800. - Liquor Sales and Distribution

By statute, all liquor sold in New Hampshire must be sold through a sales and distribution system operated by the State Liquor Commission. - Lottery and Pari-Mutuel Transfers

Beginning in fiscal year 2000, the Lottery Commission remits all net profits to the Education Trust Fund (ETF) on a monthly basis. - Meals and Rentals Tax - RSA Chapter 78-A

The Meals and Rentals tax is levied on charges by hotels, motels, restaurants, and other eating establishments. - Real Estate Transfer Tax - RSA Chapter 78-B

The Real Estate Transfer tax is assessed on the transfer of real property at the rate of $7.50 per $1,000 of real estate value and is payable by both the buyer and the seller. - Statewide Property Tax

A New Hampshire Supreme Court decision requires the State to provide an adequate public education, and to guarantee adequate funding. - Tobacco Tax and Settlement - RSA Chapter 78

The tobacco tax is earmarked for the Education Trust Fund (ETF). The transfer to the ETF for the previous month's sales are deposited within the first week of the following month.

More information...

Annual Reports (Department of Revenue Administration)

Monthly Revenue Focus Report (Department of Administrative's Services - Division of Accounting Services)

Revenue Transparency (Department of Revenue Administration)